CreditVana Review: A Comprehensive Look at Your Credit Management Solution

In today’s financial landscape, maintaining a good credit score is essential for achieving your financial goals, whether you’re looking to buy a home, secure a loan, or simply improve your financial health. One of the tools that can help you navigate this landscape is CreditVana. In this review, we will explore what CreditVana offers, its features, and how it stands out in the crowded field of credit management solutions.

What is CreditVana?

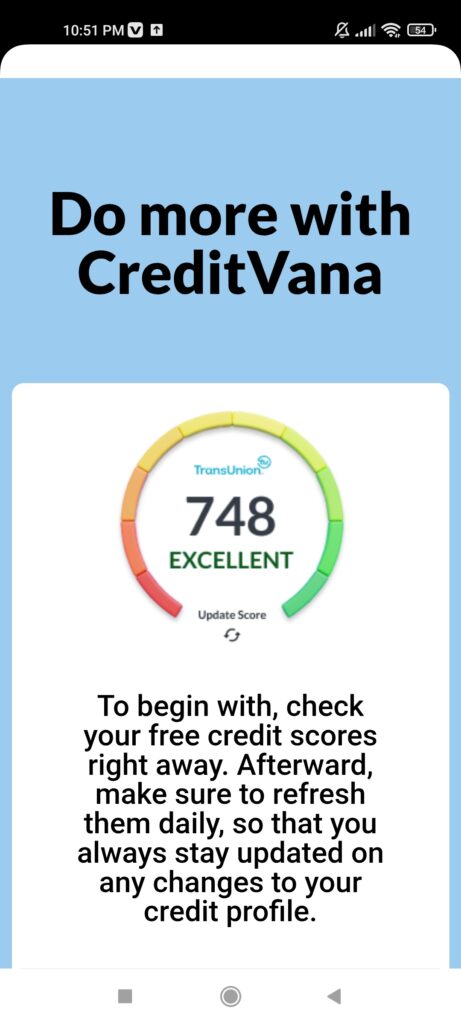

CreditVana is a digital platform that allows users to track their credit scores, manage their credit profiles, and receive personalized insights into their credit health. The platform partners with TransUnion, one of the three major credit bureaus, to provide users with real-time access to their credit scores and reports.

Key Features

1. Free Credit Scores

CreditVana provides users with access to their credit scores at no cost. This feature allows individuals to monitor their credit health without incurring any fees. The scores are updated regularly, enabling users to see how their actions affect their credit over time.

2. Daily Updates

One of the standout features of CreditVana is the ability to refresh your credit score daily. This is particularly useful for individuals who are actively working on improving their credit, as it provides immediate feedback on their efforts.

3. Credit Monitoring

CreditVana offers credit monitoring services that alert users to any significant changes in their credit reports. This feature is crucial for identifying potential identity theft or unauthorized accounts.

4. Personalized Insights

The platform analyzes your credit behavior and provides tailored recommendations for improving your credit score. Whether it’s paying down debts, making timely payments, or reducing credit utilization, CreditVana aims to guide users toward better credit management.

5. User-Friendly Interface

The user interface of CreditVana is designed to be intuitive and easy to navigate. Whether you are tech-savvy or a beginner, the layout makes it simple to access your credit information and understand your score.

Pricing

https://creditvana.pxf.io/c/6609260/3278629/41488

CreditVana is free to use for the basic features, including access to your credit score and reports. However, premium features may be available for a fee, which often includes advanced monitoring services and more in-depth credit analysis.

Pros and Cons

Pros

– No Cost for Basic Services: Users can access their credit scores and reports without any fees.

– Daily Score Updates: Keeping your credit score current is a valuable feature for those looking to improve their credit health.

– User-Friendly Design: The interface is easy to use, making it accessible to everyone.

– Personalized Recommendations: Tailored insights can help users understand how to improve their credit.

Cons

– Limited Premium Features: Some users may find that they need to pay for additional services that are offered for free by competitors.

– Dependent on TransUnion: CreditVana relies on data from TransUnion, which may not always reflect your entire credit history, especially if you have accounts reported to other bureaus.

User Experience

User feedback on CreditVana has been largely positive. Many users appreciate the real-time updates and the ease of use. The ability to receive alerts for changes in credit reports is often cited as a major benefit, providing peace of mind for those concerned about identity theft.

However, some users have noted the limitations of the free version and expressed a desire for more comprehensive services without added costs.

Comparison with Other Credit Management Tools

When comparing CreditVana to other credit management tools, it’s important to note that many platforms offer similar features. However, CreditVana stands out with its focus on providing daily updates and personalized recommendations.

– Credit Karma: While Credit Karma is another popular free credit monitoring service, it pulls data from two bureaus—TransUnion and Equifax—providing a broader picture of credit health.

– Experian: Experian offers comprehensive credit monitoring but often requires a subscription for full access to features.

CreditVana offers a middle ground, providing key services for free while allowing users the option to explore more advanced features.

Best Practices for Using CreditVana

To get the most out of CreditVana, consider the following tips:

1. Check Your Score Regularly: Make it a habit to check your credit score daily to monitor changes and stay informed.

2. Follow Recommendations: Implement the personalized insights provided by CreditVana to improve your credit score.

3. Set Up Alerts: Enable notifications for significant changes to your credit report, which can help you act quickly if any issues arise.

Conclusion

CreditVana is a valuable tool for anyone looking to manage their credit effectively. With its free access to credit scores, daily updates, and personalized insights, it stands out as a user-friendly platform in the financial technology space. While it may have some limitations compared to other services, its focus on providing essential credit management features at no cost makes it a worthwhile option for many individuals.

In an era where credit health can significantly impact your financial future, using a tool like CreditVana can empower you to take control of your credit profile. Whether you’re starting your credit journey or looking to improve an existing score, CreditVana has the resources to help you achieve your goals.

https://creditvana.pxf.io/e1YkVO: CreditVana